montana sales tax rate 2021

Montana tax forms are sourced from the Montana income tax forms page and are updated on a yearly basis. The County sales tax rate is.

States Without Sales Tax Article

To help you sort out the changes we have created a series explaining the new laws called the 2021 Legislative Roundup.

. This is the total of state county and city sales tax rates. Just enter the five-digit zip code of the. Log into My Revenue.

The state sales tax rate in Montana is 0000. There are no local taxes beyond the state rate. Did South Dakota v.

Some rates might be different in Helena. Start filing your tax return now. The Montana sales tax rate is currently.

Throughout this event we will work hard to keep you updated on the. The County sales tax rate is. Wayfair Inc affect Montana.

This is the total of state county and city sales tax rates. Instead of the rates shown for the Helena tax region above the following tax rates apply. If you need to report a sales tax exemption to your vendor you may use this form.

There is 0 additional tax districts that applies to some areas geographically within Helena. Sales tax region name. Montana is ranked number twenty nine out of the fifty states in order of the average amount of property taxes collected.

2022 Montana Sales Tax Table. The state sales tax rate in Montana is 0 but you can. The My Revenue portal will no longer be available after July 23 2021.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. The minimum combined 2022 sales tax rate for Gallatin Gateway Montana is. Distillery Excise and License Tax.

Vehicle owners to register their cars in Montana. Tax rates last updated in July 2022. You must pay Montana state income tax on any wages received for work performed while in Montana even if your job is normally based in another state.

If you have records currently saved in My Revenue we ask you to log into your My Revenue account and download them before July 23 2021. The Montana sales tax rate is currently. While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases.

Avalara provides supported pre-built integration. Did South Dakota v. The median property tax in Montana is 146500 per year for a home worth the median value of 17630000.

Montana does not have a general sales use or transaction tax. Counties in Montana collect an average of 083 of a propertys assesed fair market value as property tax per year. Montana charges no sales tax on purchases made in the state.

The Helena sales tax rate is NA. The 2022 state personal income tax brackets are updated from the Montana and Tax Foundation data. Start filing your tax return now.

This is the total of state county and city sales tax rates. The cities and counties in Montana also do not charge sales tax on general purchases so the state enjoys tax free shopping. The County sales tax rate is.

What is the sales tax rate in Shepherd Montana. The minimum combined 2022 sales tax rate for Sheridan Montana is. Before the official 2022 Montana income tax rates are released provisional 2022 tax rates are based on Montanas 2021 income tax brackets.

The 67 th Montana Legislature made several changes to Montanas tax laws. Montanas sales tax rates for commonly exempted categories are listed below. Rates last changed.

For Alcoholic Beverage Taxes please select the tax type below. The Gallatin Gateway sales tax rate is. AUGUST 31 2021.

There are additional taxes on tourism-related businesses such as hotels and campgrounds 7. Wayfair Inc affect Montana. My Revenue is Retiring on July 23 2021.

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. Did South Dakota v. TAX DAY NOW MAY 17th - There are -445 days left until taxes are due.

368 rows There are a total of 68 local tax jurisdictions across the state collecting an average. The minimum combined 2022 sales tax rate for Shepherd Montana is. TAX DAY NOW MAY 17th - There are -442 days left until taxes are due.

A Special Note on COVID-19 We understand COVID-19 impacts all aspects of our community. You can learn more about licensing and distribution from the Alcoholic Beverage Control Division. What is the sales tax rate in Gallatin Gateway Montana.

Montana MT Sales Tax Rates by City. Because there is no sales tax in the state and several counties also do not levy a local option tax the cost of registering luxury vehicles here as opposed to. Simplification of Montana Income Taxation.

Montana is one of the five states in the USA that have no state sales tax. The Sheridan sales tax rate is. The Montana sales tax rate is currently.

2021 Legislative Roundup. The State of Montana imposes a variety of registration fees on motor vehicles trailers and recreational. Department of Revenue forms will be made available on MTRevenuegov.

The Montana Department of Revenue administers the states licensing distribution and taxation on Alcoholic Beverages. The Shepherd sales tax rate is. This article is a part of our 2021 Legislative Roundup series.

Taxes Fees Montana Department Of Revenue

Montana State Taxes Tax Types In Montana Income Property Corporate

Montana State Taxes Tax Types In Montana Income Property Corporate

States Without Sales Tax Article

How High Are Cell Phone Taxes In Your State Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Montana Income Tax Information What You Need To Know On Mt Taxes

Montana State Taxes Tax Types In Montana Income Property Corporate

Taxes Fees Montana Department Of Revenue

Taxes Fees Montana Department Of Revenue

State Income Tax Rates Highest Lowest 2021 Changes

State Corporate Income Tax Rates And Brackets Tax Foundation

States Without Sales Tax Article

U S States With No Sales Tax Taxjar

Taxes Fees Montana Department Of Revenue

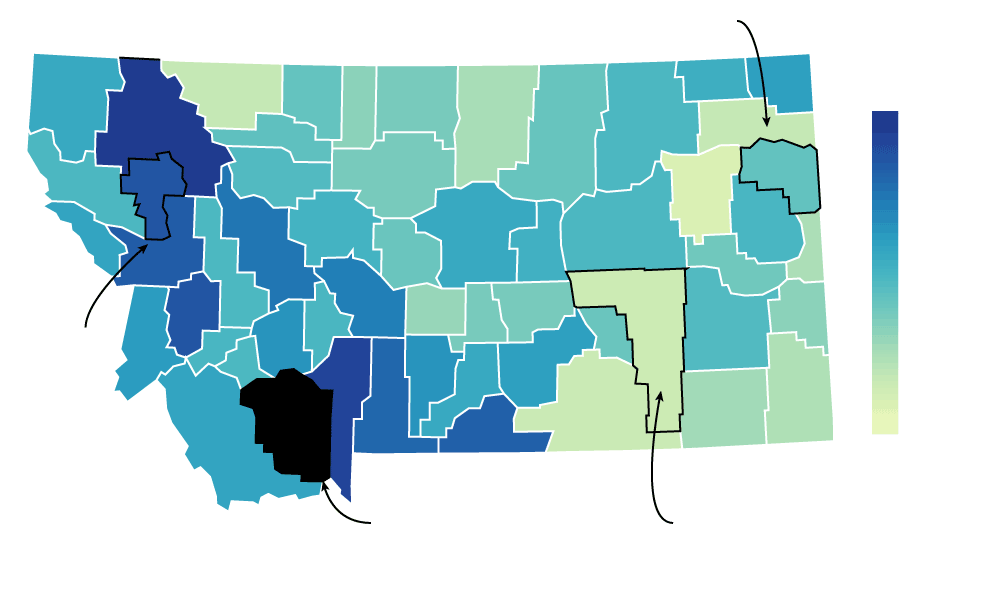

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press